This is the second of the dividend stock article series, where You have the power to decide. The dividend-paying company that gets the most votes on my Instagram poll is the one I will write an article about. Today, I am covering AT&T(T) in the second of the requested dividend stock article series.

Check out the first requested article about Visa(V) here.

The Company

AT&T(T) is one of the most popular income stocks amongst retirees. With a high yield and a 35 year dividend growth streak, it’s easy to understand why. Throughout various recessions and economic downturns, this company has managed to keep raising its shareholders payout year-by-year.

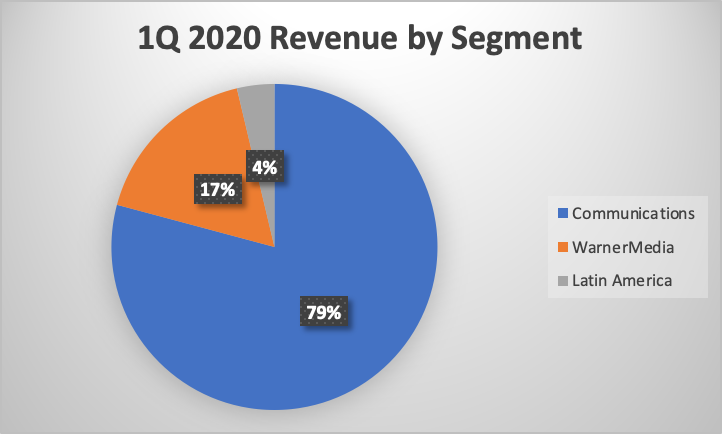

The main source of revenue for AT&T is its communications business segment.

The Mobility component of that segment sells phone plans, whilst Entertainment Group provides internet and TV bundles plus makes some money off advertising as well.

The bundles that AT&T sells are often yearly subscriptions, which make the company’s cash flows quite predictable over the short-term. However, the classical TV bundle is under serious threat from streaming services such as Netflix, Disney+ and others.

After the Time Warner acquisitions, At&T generates revenue from TV shows, films and video games as well. That business segment is called WarnerMedia.

Dividend

The dividend is what attracts investors to this company. With a track record of 35 years of consecutive dividend raises and a 7% yield, I can understand why. AT&T’s dividend raises are one of the most predictable I’ve seen – for the last decade they have raised the quarterly dividend by $0.01 per year without fail. This equates to a 2.3% average growth rate over the last decade.

Looking at 2019 free cash flow as a guide, the dividend is covered by a safe FCF payout ratio of 52%. Whilst there will be a hit to free cash flows due to the current economic distress, I expect the dividend to remain well-covered.

My criteria for dividend metrics is:

- Yield >2%

- 5-yr average dividend growth rate of >5%

- Dividend growth streak >5 years

- FCF payout ratio <60%

AT&T scores 3 out of 4 on my dividend criteria.

Balance Sheet

My biggest concern regarding this company – the debt levels.

After the TimeWarner acquisition, debt levels really ballooned.

This company has more debt than some countries, with net debt at around $150 billion.

Debt/Equity stands at 1.05, which is above my 0.5 criteria.

Debt/EBITDA is currently 3.3, slightly above my max criteria of 3. It would take T more than 3 years to pay off all its debt, if EBITDA stays the same and the company directed all money towards paying down debt.

Interest Coverage is a very low 3.7x, meaning T can cover its interest payments just 3.7 times over from its yearly EBIT. Usually, I want interest coverage to be higher than 8x for my investments.

AT&T’s balance sheet scores 0 out of 3 on my criteria.

That doesn’t mean it’s in immediate danger of not being able to service its debt. Due to the non-cyclical nature of the communication business, they can predict their cash flows with reasonable accuracy. Phone service and internet isn’t one of the first things people cut from their budgets during downturns.

T is also actively paying down the debt and can get under Debt/EBITDA ratio of 3 soon if things go to plan. The TimeWarner acquisition that increased debt levels, will also result in growing cash flows. Those cash flows can be used to pay down debt even faster. However, the debt levels are still elevated right now.

Profitability

Over the last decade, the average ROE was 12% with ROIC at 8% on average during the same time period.

ROE is above my criteria of 12%, whilst ROIC falls short of my 12% criteria.

As evidenced by the FCF/Sales ratio, free cash flow generation is strong.

Over the last decade, around 12% of revenues on average were turned into free cash flow.

My criteria when analysing companies using FCF/Sales is >5%.

This company has ample cash left over after accounting for all the expenses to keep the lights on. As cash flow is what dividends are paid out of, it’s an important metric.

AT&T scores 2 out of 3 on my profitability metrics.

Valuation

For a company paying a generous dividend and generating a lot of free cash flow, AT&T is attractively valued.

Forward-looking P/E ratio is around 9 (my criteria <15).

P/FCF is 8 (my criteria <15).

CAPE ratio stands at 11 ( my criteria <20).

The market is likely valuing AT&T at a lower multiple due to the following reasons:

- Limited organic growth prospects

- Cable-cutting due to competition from streaming services

- High debt levels

If AT&T pays down debt and successfully integrates TimeWarner into its business, the market might assign a higher multiple to the company’s shares.

Valuation score for AT&T is 3 out of 3.

Risks

Whilst the elevated debt levels pose the most immediate threat, I don’t see T struggling with it in the short term.

The bigger risk to AT&T’s business is the limited organic growth prospects and the increased competition from streaming services. There is a limited amount of phone plans you can sell to people. And with players such as Netflix and Disney+ becoming more and more popular, demand from traditional cable TV is decreasing. The cable-cutting trend has been accelerating and T needs to come up with a plan to combat this slow erosion of its business. This is the first year, where I personally cancelled my TV package as well.

The WarnerMedia segment will provide a boost to the cash flows, however it’s a much more unpredictable business. You can’t predict with a high degree of certainty which movie will be a big hit in the cinemas or which video game will do well.

Summary

AT&T is a conservative income investment with a solid yield that is safely backed by free cash flow. Don’t expect too much growth from this company, as the biggest parts of the business are slow-growers and facing some competition. The current high debt levels are a concern, but the company can improve the balance sheet ratios over the coming years if they keep producing free cash flow at a high rate. Successful de-levering might also provide a boost to the stock price.

AT&T scores 8 out of 13 on the metrics I use to analyse dividend investments.

Disclaimer: This is NOT an investing recommendation. You can lose your invested capital. I am not a financial professional of any kind. The article published should NOT be considered to be investing recommendation or basis for financial planning. Before making any investing or financial decisions, contact an appropriate professional. All content on this website is for entertainment purposes only.