I bring to you the requested dividend stock analysis on Simon Property Group(SPG). It was voted by my Instagram followers. To take part of the voting, make sure to keep an eye out for the next poll.

The Company

Simon Property Group(SPG) is a retail REIT with a primary focus on Class A malls. It owns 234 shopping properties with a total sq footage of 191 million.

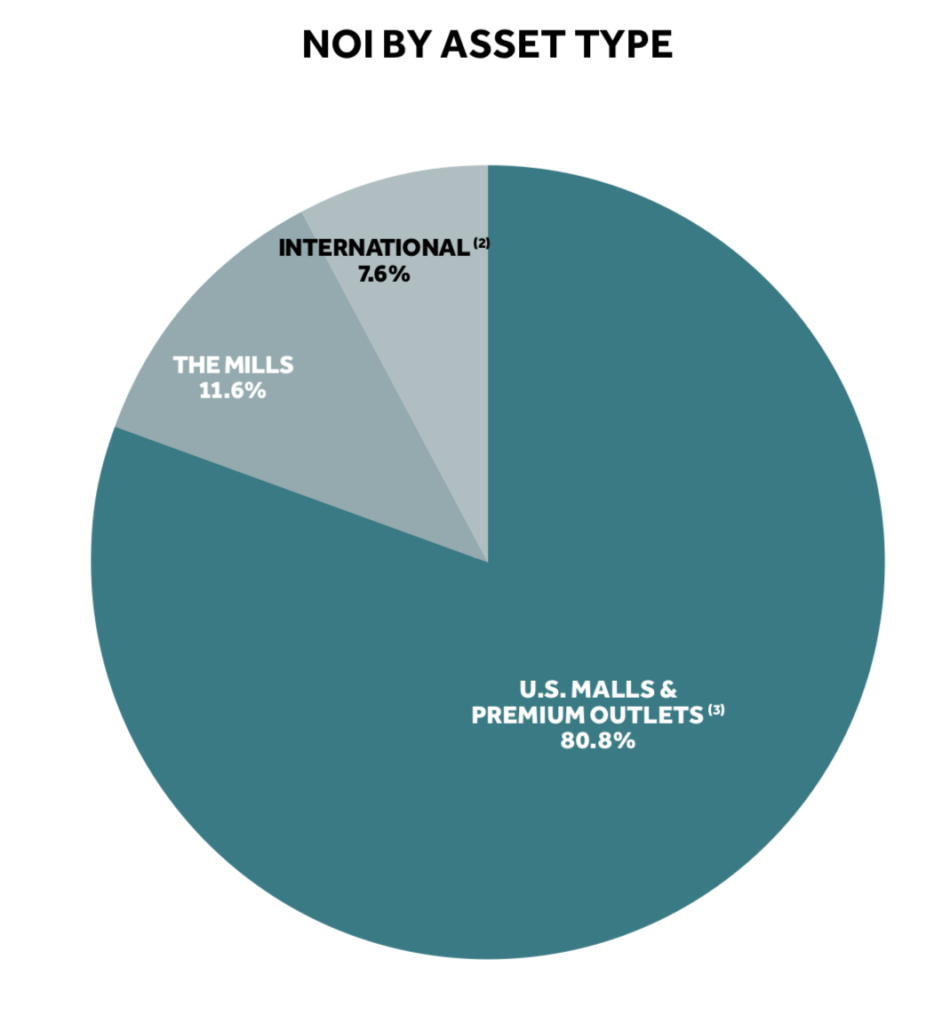

The company derives rental revenue from 3 main asset types:

- U.S Malls & Premium Outlets- 80.8% of NOI (Net Operating Income)

- The Mills- 11.6% of NOI

- International- 7.6% of NOI

Thesis

SPG stock has been punished severely, as the business was affected by the coronavirus pandemic. As cash flows are set to decline, some of stock price decline has been warranted. However, the sell-off looks extremely overdone in comparison with the business prospects.

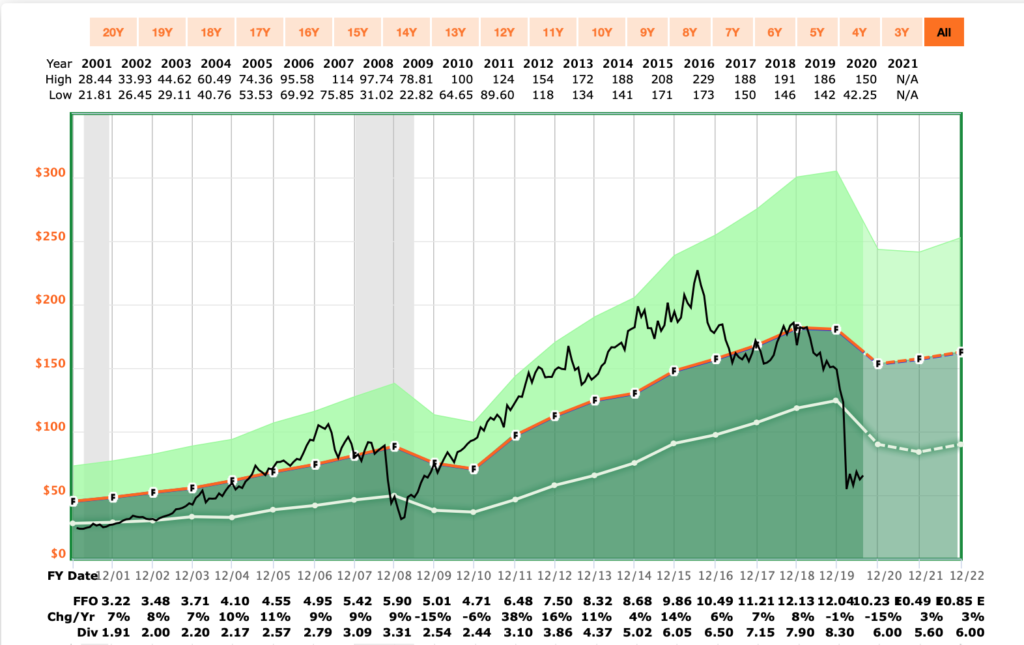

As we can see on the graph below, analysts predict that FFO will decline 15% year-over-year.

The stock price is currently around -53% year-to-date.

Although declining FFO is negative news, I think a 53% drop in comparison with a one-off 15% decline in FFO, because of a black swan event, is extremely overdone.

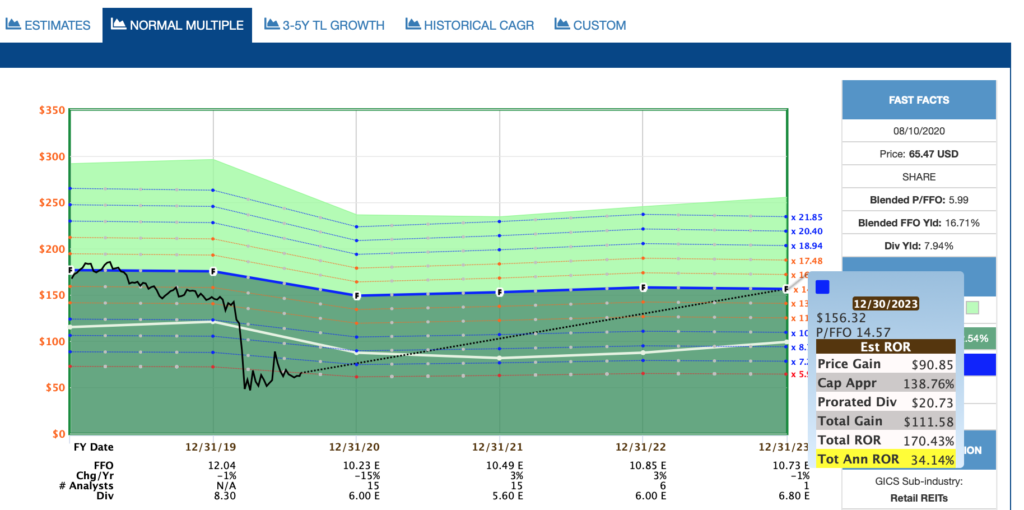

That’s why I continue to hold SPG and see much upside from current valuations. SPG has traded at an average FFO valuation of 14.57 over the last 20 years. If the stock price were to return to the previous average valuation, SPG offers a potential yearly returns of 34% over the next couple of years.

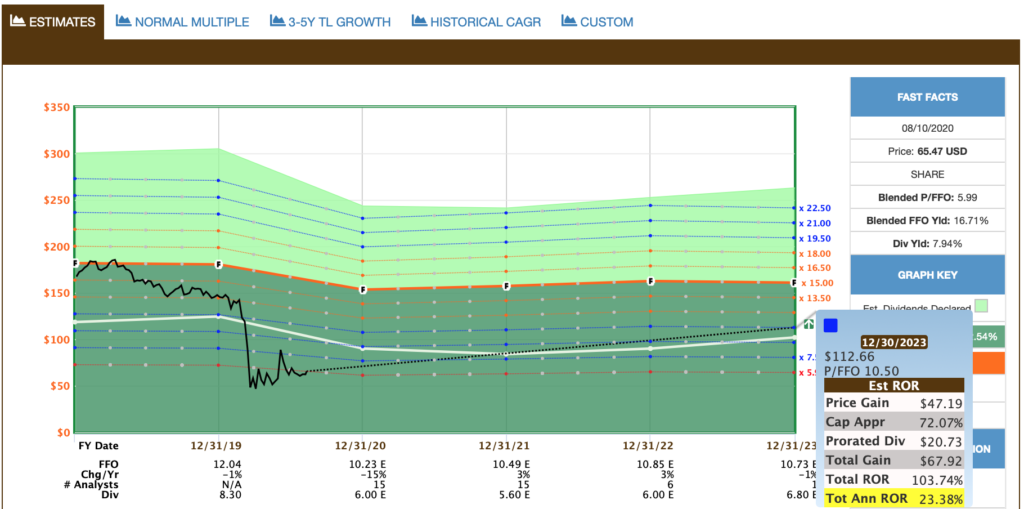

Due to industry headwinds, it might happen that the market isn’t willing to pay the historical average valuation for SPG anymore.

Even if SPG would trade significantly below its historical FFO valuation at 10.5 P/FFO (28% below historical average), it still offers the potential for 23% yearly returns over the next couple of years.

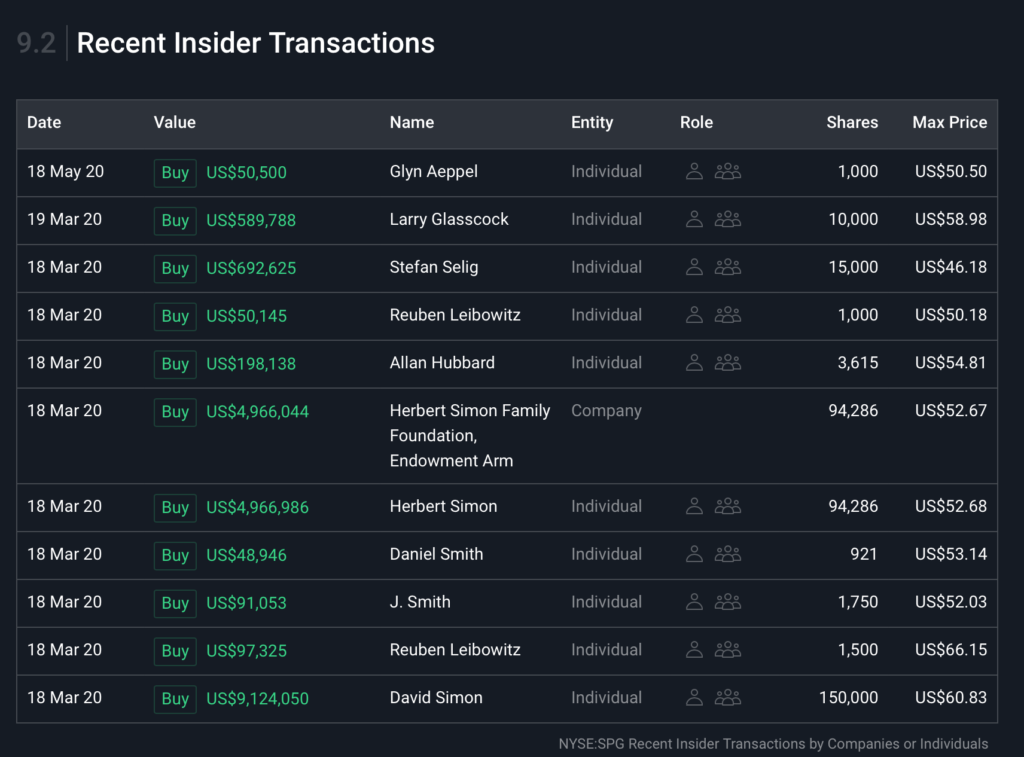

Insiders are buying SPG stock

Simon Property Group insiders have bought more than $20 million worth of shares over the last few months.

These are people that have the best view of the business operations. To see them buying shares of SPG heavily shows that they are confident on the business recovery.

Dividend

Based on today’s stock price, SPG is yielding 7.5%.

The bad news is that the quarterly dividend has been cut -38% from $2.1 to $1.3.

Good news is, that it makes the dividend much more sustainable. Based on analyst expectations for 2021 FFO, the dividend will be covered by a 50% FFO payout ratio next year.

Eventually, it will depend on rent collection figures and rent deferral terms with tenants.

Rent collection has trended up, with around 73% collected in July.

However, as SPG also cut it’s dividend during the Great Financial Crises, it puts the reliability of dividend payments under question.

I hold my shares as I see significant potential for upside, but I’m not willing to increase my position as my primary goal is reliable income.

Balance Sheet

There is no question that retail is hurting right now. However, it’s due to external forces. Before CoVid pandemic, SPG was actually doing really well as lease spreads were increasing.

What is crucial right now, is that SPG has the liquidity to weather the storm.

The company has roughly $9 billion in liquidity and maintains a conservative debt level.

Debt to NOI ( net operating income) is at around 5.4 right now.

As a result of those metrics, S&P rates SPG with a credit rating of A.

SPG is also well within its debt covenants and shouldn’t have any trouble raising additional cash through debt offerings if necessary.

Risks

Whilst bears are taking a victory lap after SPG’s troubles, nobody saw CoVid coming. It has hurt the space where SPG operates very strongly. The positive vaccine news and the fact that around 90% of SPG’s locations are now open suggest that the worst might be behind us. Much has been said about the “retail apocalypse” that is threatening U.S malls. It’s true that there is too many malls in the U.S per capita. The physical retail space is also threatened by e-commerce.

If you believe that all malls will become obsolete, don’t invest in SPG. However as the increasing lease spreads proved pre-covid, there is still demand for Class A mall space. SPG is also actively re-developing its properties into more multi-use locations. It’s not just shops at the malls anymore. It’s dining, entertainment etc.

The recent talks with Amazon regarding repurposing some mall space into Amazon fulfillment centres also proves that there is always demand for prime location real estate.

Summary on SPG

Simon Property Group business was hit hard by the pandemic. This was an external force so I can’t blame the management in this. The company has the liquidity to withstand this difficult period. Although the dividend has been reduced, it still offers a meaningful yield right now. However, as the dividend was also cut during the financial crises, SPG’s reputation as a reliable dividend payer has been cast in doubt. Shares offer great potential for capital gains from current depressed valuations if FFO multiples were to return to normal. I rate SPG a “BUY” for capital gains, but I am not adding to my position due to the dividend situation.

Disclaimer: I hold a long position in SPG. This is NOT a recommendation to buy or sell any shares. You can lose a part of or all your invested capital.I am not responsible for the accuracy of any of the figures presented in the article. I am not a financial professional of any kind. Any stock transactions or analysis published should NOT be considered to be investing recommendations. Before making any investing or financial decisions, contact an appropriate professional.This website should be viewed for entertainment purposes only.