With a difficult year coming to a close, it’s a great time for reflection and planning. In 2020 we faced great challenges and uncertainty on the investment front. Virus-induced lockdowns disrupted the global economy and the markets were extremely volatile. However, as a result of monetary and fiscal policy response from governments and central banks across the globe – we finish the year with stock markets at all time highs. This creates a complex and unprecedented situation, where investors have to be more careful than ever. In this post I wanted to share my personal approach – where to invest in 2021 and what are the investments that I’m avoiding.

#1 Investments that I’m avoiding – Bonds

Bonds have historically been the safest income investments.

However, as a result of monetary policy, the yields have crashed to levels, that are simply not providing any return.

Now, bond investors are losing money in real terms.

The U.S 10-yr Treasury is currently yielding 0.94%.

Federal Reserve expects inflation to be 1.8% in 2021.

That means an investor purchasing the 10-yr Treasury Bill will lose money in real terms. The investor’s purchasing power will decline by -0.86% (0.94% yield minus 1.8% inflation) per year.

The Federal Reserve slashed interest rates to stimulate the economy as lower borrowing costs can encourage companies and individuals to spend and invest more. In the short run, it boosts the economy, but how that will affect the economy in the long run is the big question here. I am not here to argue macroeconomics – just giving my thoughts on what I invest in and why.

Investing in bonds right now is locking in an extremely low yield, with 0 growth prospects.

Although some institutions are mandated to hold a certain percentage of assets in bonds, I don’t find bonds attractive from an individual investors’ viewpoint.

#2 Investments that I’m avoiding – S&P500 Index funds/ETFs

Many investors seem to think of S&P 500 index funds and ETFs as a guaranteed way to great returns.

I don’t have an issue with passive investing – index fund invention has dramatically lowered investment fees and made it accessible for all.

They have also returned close to 10% a year on average – an impressive return.

However, investors need to be aware that although the average return is 10% – it can vary greatly year by year.

You also need to know the price you are paying for earnings from the companies within the index – and it’s impact on future returns.

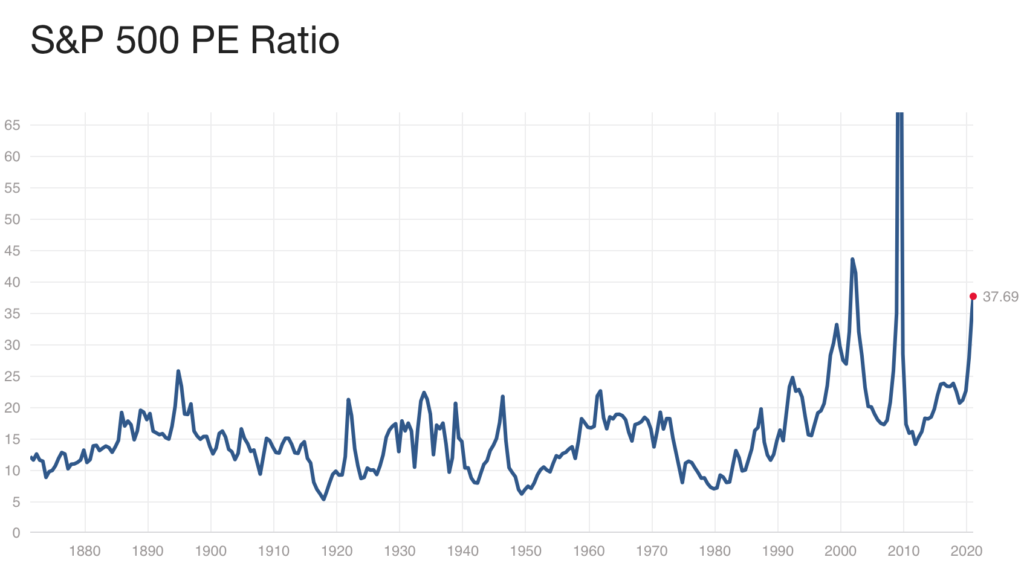

Investing in 1980 when the P/E was below 10 is very different than putting money to work in 2000 at a P/E ratio above 40.

Current valuation of just under 38x earnings is extremely expensive when compared to the mean valuation of around 16x earnings.

This is a major headwind for future returns.

As we can see on the graph below, investors are having to pay a lot for earnings right now, when compared to historical levels.

If valuations revert to the mean in the next 8 years – S&P is likely to deliver just 1% annual returns.

For everybody counting on double-digit returns in the next decade, this can be a difficult period to stomach.

Where to Invest in 2021?

It’s not all doom and gloom – there are great investment opportunities out there for long-term prudent investors.

Finding those opportunities requires a more active investing approach – filtering potential investments for quality, safety and value.

#1 Dividend Growth Stocks

Reliable, growing dividend income is the primary goal of my personal investment plan.

Focusing on dividend income also means, that I don’t require the stock price to go up to have a successful investment.

Dividend income relies on continuous strong business performance, not stock price.

As long as the companies are generating cash flows and sharing those with shareholders – I am making a return on my investment. Regardless of what the stock price does in the short run.

Identifying great dividend stocks

Not all dividend growth stocks are great investments.

Just because a company pays a high dividend, that doesn’t mean it can sustain it in the future. I wouldn’t invest in Exxon(XOM) for example, as it has to currently sell assets and issue debt just to keep funding its dividend.

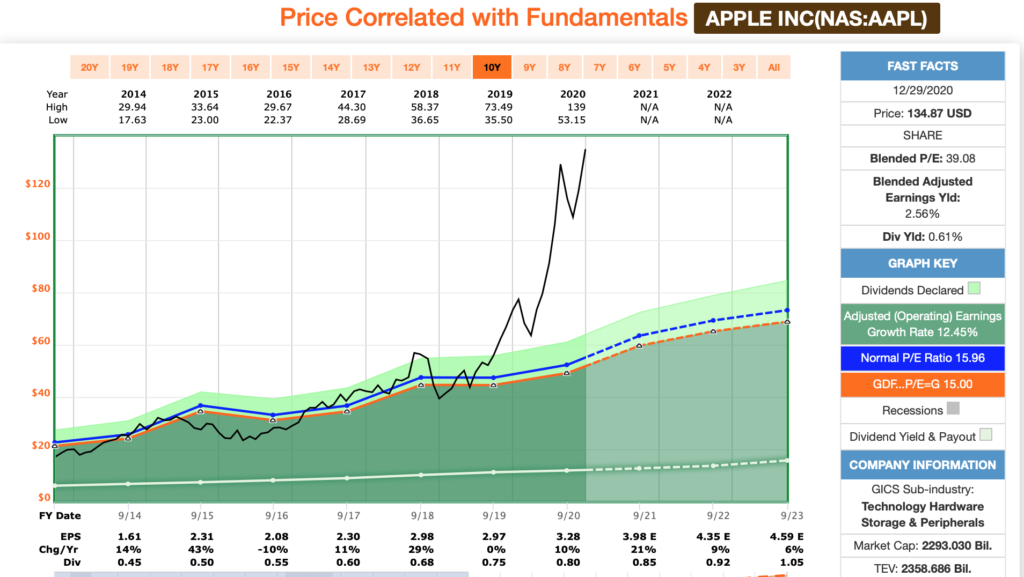

Also I wouldn’t invest in a quality company, if the stock was trading at an overvalued level. For example, Apple is not an attractive investment for me at 39x blended P/E, when it has historically traded at around 16x blended P/E.

A great dividend investment is most importantly a great company.

It generates predictable cash flow, that it shares with shareholders, has a strong balance sheet and trades at a fair valuation at the time of purchase.

I analyse 1000’s of investments, that I filter through my 13-Step Investing Checklist to find attractive investments that fit my goals.

It’s a lot of work – but it’s worth it. I’d even argue that it’s absolutely necessary in current market conditions.

#2 Equity REITs

Equity REITs are especially attractive in 2021 as valuations still haven’t fully recovered from CoVid-lockdown crash, even though fundamentals are strong and leverage low compared to 2008/09 crash.

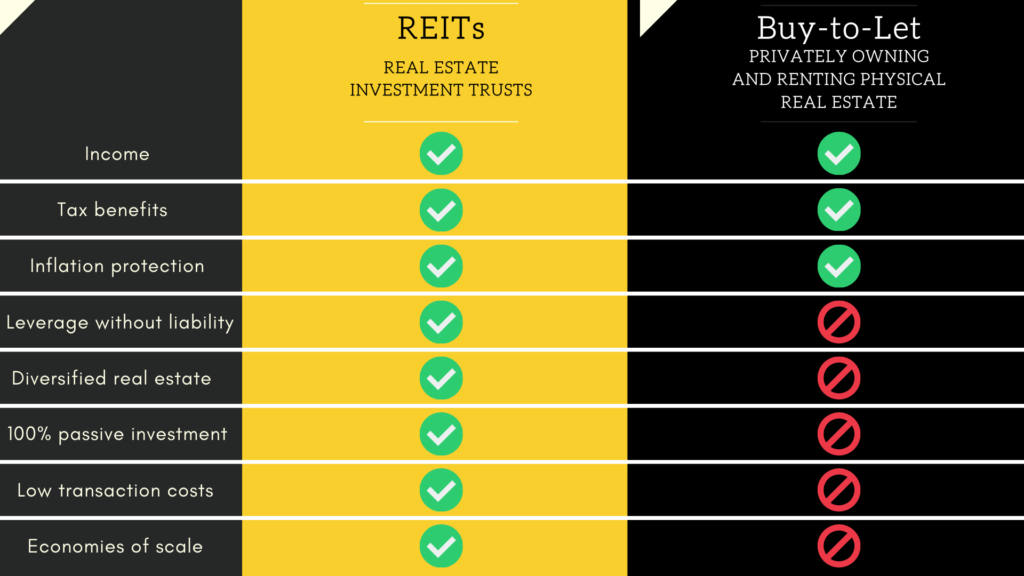

I invest in cash-flowing real estate through the stock market in the form of equity REITs.

You can see why I prefer REITs to physical buy-and-let real estate investing on the comparison graph below.

Equity REITs are not to be confused with mortgage REITs. The former own and lease out real estate while the latter acts more like a bank. Mortgage REITs don’t own the real estate, they just finance it. Mortgage REIT business model is heavily dependant on interest rates(something that they have no control over), which makes it a poor investment in my eyes for stable dividend payments.

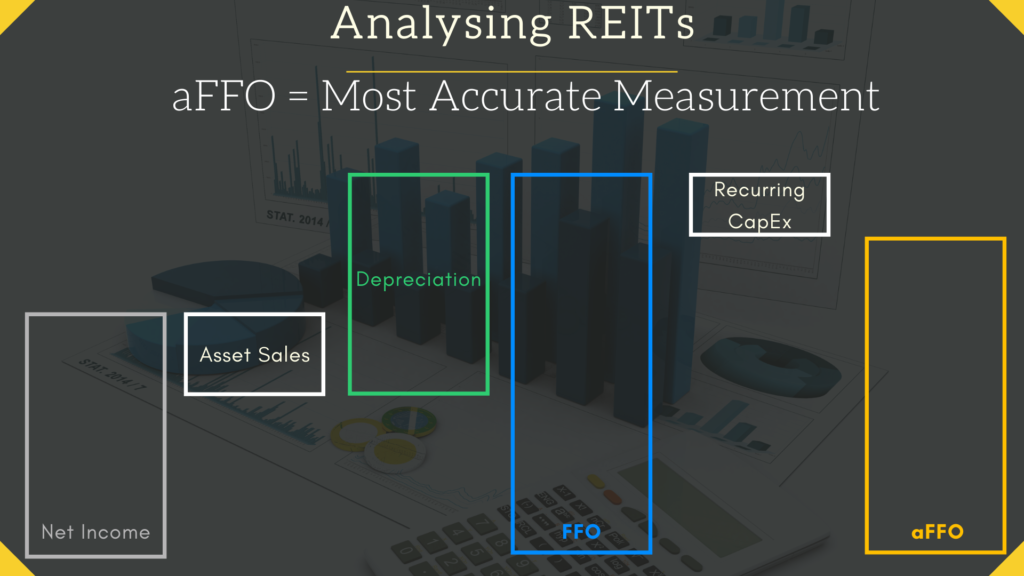

REITs are more complex to analyse, as they can’t be measured using the same ratios as other corporations.

For example using GAAP earnings doesn’t give an accurate overview of a REITs profitability. That’s due to non-cash depreciation charges.

More accurate measures are FFO and aFFO.

You can see how those are calculated on the image below.

Although REITs require specific knowledge to properly analyse, they are a potentially great investment at the right valuation, which is why I aim for a 25% REIT allocation in my portfolio.

Summary

It’s a tough environment for investors in 2021 with bond yields at historical lows and stock markets trading at expensive valuations.

I’m putting my money where my mouth is and regularly investing in dividend-paying companies and REITs regardless of the macro situation.

However, I believe caution and careful filtering of investments is required to do well going forward.

Wish You all successful investing in 2021!

Disclaimer: This is NOT a recommendation to buy or sell any shares or to follow a particular investing strategy. You can lose your invested capital.I am not responsible for the accuracy of any of the data presented in the article. I am not a financial professional of any kind.None of the information here should be considered as a basis for financial planning. Any stock transactions or analysis published should NOT be considered to be investing recommendations. Before making any investing or financial decisions, you should contact an appropriate professional.This website should be viewed for entertainment purposes only.