I’m always interested to hear, which stocks other dividend growth investors are following and researching. That’s why, I ask followers to pick the stocks they would like me to write about. Today, I bring to you the latest requested dividend stock analysis article on Home Depot(HD). To pick the next company in this requested dividend stock analysis series, keep an eye on my Instagram page.

Home Depot

Home Depot(HD) is the largest home improvement specialty retailer in the world. The company offers more than 30,000 products in its 2300 stores and more than 1 million products through online channels.

The company caters to 2 different types of customers:

- DIY Customers – People who buy HD products for their projects such as renovations or installations either in-store or through online channels. Customers who visit HD benefit from the expert advice from HD associates and the company also offers workshops and clinics to help their customers make better use of the products.

- PRO Customers– Professional handymen, property managers, renovators. Home Depot offers specialised products and services to those customers such as worksite delivery, credit programs, inventory management etc.

Home Depot’s business is performing very well. They are generating a lot of cash flow and achieving a very high return on the capital they re-invest into their business.

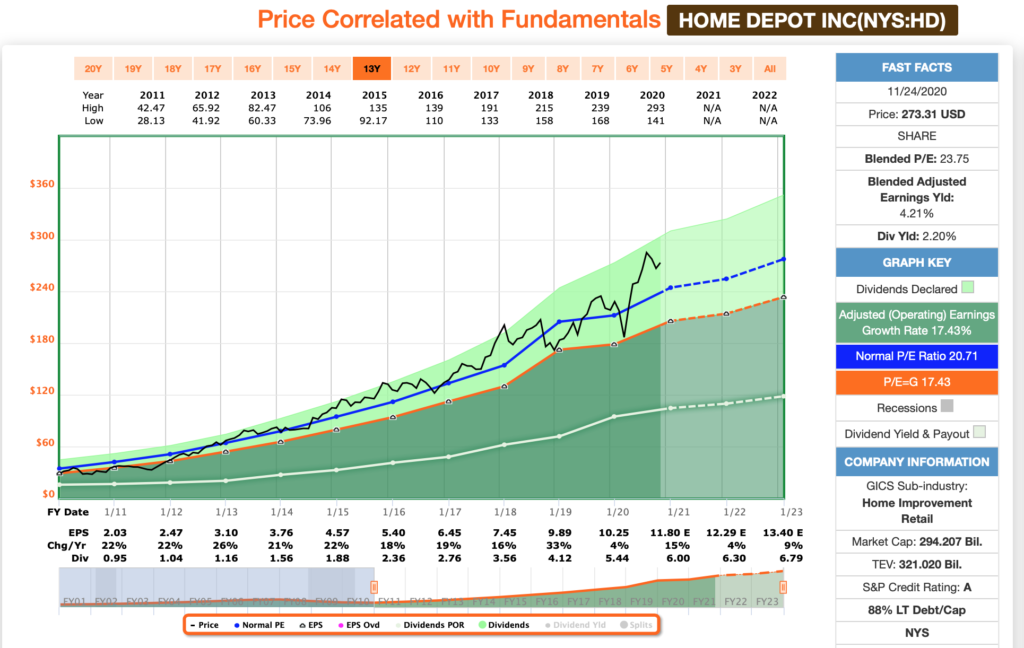

The revenue and earnings growth the company has achieved during the last decade is very impressive as we can see on the chart below.

The company has achieved 41.6% return on invested capital in the trailing twelve months and has turned more than 10% of revenue dollars into free cash flow. Those are very impressive figures.

Dividend

The current dividend yield is 2.2%.

The dividend growth in those last 11 years has been incredible with a compounded annual growth rate of just under 18% and the last raise coming in at 10%.

As the company has grown its earnings rapidly during the same time period, the dividend payout ratio of 53% is still very safe which leaves room for future raises.

Balance Sheet

Home Depot carries an A credit rating from major agencies. They have a ton of liquidity on the balance sheet as see on the image below and access to more borrowings at a low rate if needed.

The company has borrowed a lot of money over the last decade to fund its growth projects and buybacks, but the debt is easily serviced by earnings.

Debt/EBITDA stands at around 2, which is a safe level.

Interest payments are covered more than 13x over by yearly EBIT, which shows that the company can comfortably service the debt load.

Valuation

As Home Depot is growing its earnings at a very fast rate, it deserves to be trading at a higher multiple than the broader market.

However, the current valuation of 24x P/E is very high, even when compared to the company’s historical 10- yr average P/E of 20.

Shares of Home Depot were briefly trading at a very compelling valuation in March this year. Back then the dividend yield was 3.9% compared to 2.2% today.

My fair value estimate for HD based on expected 2021 earnings is around $200 per share. This would represent a P/E multiple of 17x and a dividend yield of 3%.

Risks

HD is a very profitable company with a strong balance sheet. Although they are a retail company, their operations are somewhat “Amazon-proof” so there is no immediate threat to their business.

The company has been issuing a lot of debt to buy back stock. It’s not a big problem, as they can comfortably cover the interest payments. However, I don’t like company’s buying back their stock at a high valuation as it doesn’t create much shareholder value. Unfortunately, during the market drop when it would’ve made sense to buy back stock – they chose to suspend the buyback program instead. I can understand the reasons for that, as it’s an uncertain economic period, but I would like the management to be more selective with its buyback program.

Buyers at current prices also have to take valuation risk into account. As shares are trading at a higher-than-average valuation for HD, a reversion to the mean valuation would mean a significant stock price decline.

HD’s main competitor is Lowe’s. They essentially operate in a duopoly on the U.S market and both businesses have performed very well over the last decade. Lowe’s is expected to grow its earnings faster over the next few years, but HD has higher margins.

Summary

Home Depot is a great company by all accounts. It’s growing its revenues, earnings at a very fast rate and getting a very high return on its invested capital. This has resulted in generously growing dividends for shareholders.

Currently, the shares are trading at a too high valuation for me, but HD remains on my watchlist as I look for a better entry point.

At current valuation it’s a “HOLD” rating from me.