I’m always interested to hear, which stocks other dividend growth investors are following and researching. That’s why, I ask followers to pick the stocks they would like me to write about. Today, I bring to you the latest dividend stock analysis requested by You –Texas Instruments(TXN).

To pick the next company in this requested dividend stock analysis series, keep an eye on my Instagram page.

Investment Thesis

What makes Texas Instruments such a great company:

- Strong earnings and cash flow growth supported by margin expansion.

- Management focused on free cash flow as the primary driver of long-term value.

The best measure to judge a company’s performance over time is growth of free cash flow per share, and we believe that’s what drives long-term value for our owners.

– Rich Templeton, Chairman, president and CEO

- All remaining cash after investments to grow the business is returned to shareholders via dividends and buybacks.

- Strong competitive advantage as evidenced by a high Return On Invested Capital.

- Rock-solid, A+ rated balance sheet to weather any economic conditions

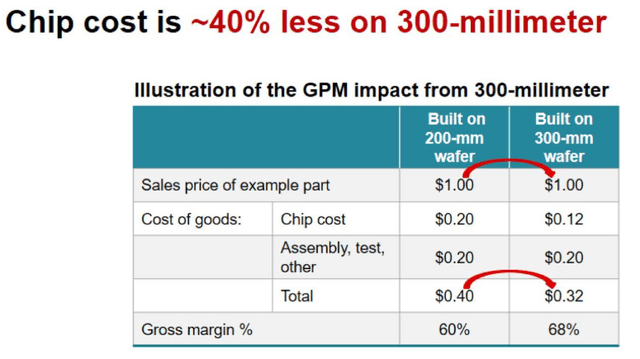

IMPORTANT: A major reason why TXN is able to achieve such high margins is due to their ability to manufacture analog chips on 300-mm wafers, which gives them a major cost advantage.The company is building 2 new 300-mm plants that should be operational next year.

Company Introduction

Texas Instruments(TXN) designs, manufactures and sells semiconductors that are used in electronics most of us use daily – from smartphones and cars to kitchen appliances and door locks.

Since its founding in 1930, the company has managed to thrive and innovate in times of rapid technological advances. Well known for developing the first hand-held calculator, their products were even used in lunar exploration modules that landed on moon’s surface in the ’60s. The company employs over 30,000 people in 30 countries and has a portfolio of over 40,000 patents on their products.

Dividend

The current dividend yields 2.5%, is growing rapidly and is well-covered by earnings and cash flows.

TXN has offered shareholders one of the fastest-growing dividends on the market, with dividend growing at a compounded annual growth rate of 25% since 2003, and the latest raise in September coming in at 13%.

As the company has grown its earnings rapidly during the same time period, they’ve managed to maintain a very safe dividend payout ratio of 53%.

The majority of the rest of the free cash flow has been used for buybacks, with the company buying back around 46% of all shares outstanding since 2004.

Balance Sheet

Texas Instruments has a rock-solid balance sheet, which is evidenced by its credit rating of A+.

The company currently has more cash on its balance sheet than debt.

Debt/EBITDA is a very safe 0.8x and interest payments are covered by yearly EBIT(earnings before interest/taxes) more than 46x over.

The strength of the balance sheet further strengthens the safety of the dividend and allows the company to borrow money at extremely low rates if needed.

Valuation

I estimate a company’s Fair Value based on the average result of 2 valuation methods:

- 10-yr average earnings multiple applied to current year’s earnings.

- 2-stage discounted cash flow model with a 10% discount rate.

Below are the Fair Value targets based on both methods and the average of the 2.

The average of the 2 valuation methods comes out to $170.1 per share.

Compared to the current share price of $188.4, shares are ~9% OVERVALUED.

Risks

More than half of TI’s revenue is generated in China. An escalation of trade war between the U.S and China might put pressure on the Chinese demand for TI’s products. However, there is limited alternatives to TI’s product offering which might soften the blow.

Although earnings and cash flows are growing rapidly, organic revenue growth has been lagging that. Not necessarily an issue, since margin expansion is boosting cash flows, but there is a limit on how much margins can improve.

Shortages and price increases of the supplies needed for chip manufacturing (silicon for example), could also negatively impact TI’s operations.

Summary

Texas Instruments is an incredible business. It constantly generates strong, growing cash flows, achieves high margins and returns on invested capital AND has a fortress, A+ rated balance sheet. On top of that, the management is extremely shareholder-friendly and aims to return all excess cash flow to investors in form of dividends and buybacks.

I have a long position in TXN and keep monitoring the valuation for potential buying opportunities, but at the current valuation it gets a “HOLD” rating from me.