Thesis

An investment in Gladstone Land Corporation(LAND) is an investment in a non-correlated real asset that produces cash flows to investors. Farmland business has been largely unaffected by the pandemic. The company expects its rent payments from tenant-farmers to pay on time. Farmland values have historically also held up well in times of economic instability. Gladstone pays an attractive ~4.5% yield. It is paid monthly and can be interesting to income investors. In it’s recent update, the company re-assured investors on the safety of the dividend. The company recommended the board of directors to declare a dividend at least equal to the current rate. Looks like this 4.5% yield is unaffected by the coronavirus so far.

The Company

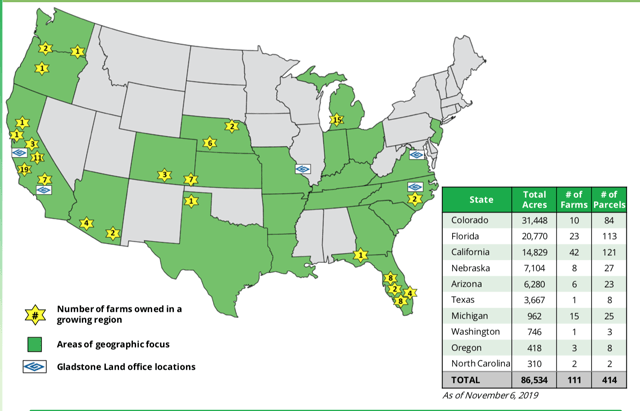

Gladstone Land Corporation is a real estate investment trust that specializes in buying up farms and leasing them out to farmers. Farmland is mainly rented out to farmers on a triple-net basis, meaning that the farmer is responsible for maintenance and pays insurance and taxes in addition to the rent. The company currently owns 113 farms amounting up to 88.000 acres of land. Gladstone’s tenants mainly farm fresh produce crops that are planted and harvested annually – such as berries and vegetables. Second area of focus for the company is farmland where long-lived crops are planted in every 10-20+ years – producing mostly nuts and fruits. All of Gladstone’s farm have their own water supply. Currently, 100% of Gladstone farms are occupied and leased out to 70 different tenants in 24 states. Gladstone’s tenants should also benefit from the trend towards healthier eating, with 95% of Gladstone’s portfolio GMO free.

Source: Gladstone Land Corporation Investor Presentation ( as of Nov 2019 )

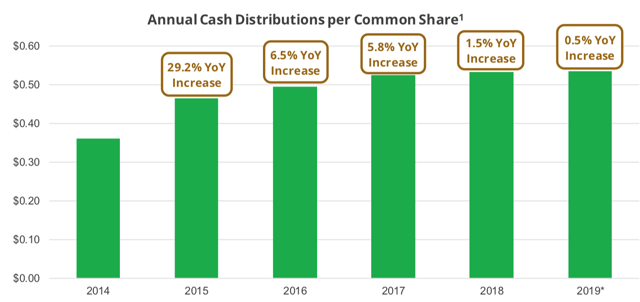

4.5% Dividend Yield

Since going public in the start of 2013, LAND has paid 85 monthly dividends and is currently yielding around 4.5%. The company’s recent update on the sustainability of the dividend gives investors confidence in Gladstone’s ability to keep rewarding shareholders. The 4.5% yield seems to be unaffected by the coronavirus so far. That situation is of course not guaranteed to stay stable, but at this moment in time, the company doesn’t expect its tenants to struggle with rent payments which is what funds the dividend payments. Adjusted FFO payout ratio in 2019 was 94% which doesn’t leave a lot of room for safety if tenants do start to struggle with rent payments.

Source: Gladstone Land Corporation Investor Presentation

Balance Sheet

As of December 31, 2019 the loan-to-value of Gladstone properties amounted to 54%. This is slightly on the high side for REITs usually, but the company is comfortable with this level, as farmland as an asset class is generally seen as low-risk. 99% of LAND’s borrowings are at a fixed rate of 3.9% for another six years, which somewhat insulates the company from interest rate risk. During the recent earnings call, management said that there is only 2% of total debts outstanding due for repayment over the next 12 months.

Valuation

Although LAND’s business is not facing any disruptions yet, the stock price still plummeted from a high of $14.44 to $9.61 for a decline of 33%. It has since recovered a bit and is trading at $11.85 per share. The current stock price is still around 18% below the stock’s 52-wk high. At the time of writing, LAND is trading at around 18 times FFO. This is by no means a bargain when compared to some other REIT sectors but as the company is proving to be resilient to the current pandemic, it might be worth a premium.

Risks

Although the tenant’s operations haven’t been affected so far, it’s not guaranteed that it will continue like this. Operations depend on farmworkers staying healthy.

Speciality crops such as fruits and berries can’t be stored for long time periods. The tenant’s rely on availability of labor to harvest the crops without delay and ship it to customers. In the risk of labor shortages, fresh food farmers risk losing an entire harvest. This is the worst case scenario. Farming is also subject to risks from plant diseases and weather conditions. Additionally, I couldn’t find information available on tenant’s rent coverage.

Summary

LAND offers an option of investing in a non-correlated asset with cash flows that are currently safe as stated by the management. There are some unique risks attached to farmland investing. They need to be taken into account. Investors should do a deep dive into this company’s financials to see if it fits their investment plan and risk tolerance.

Disclaimer: This is NOT a recommendation to buy or sell any shares. You can lose a part of or all your invested capital. I am not responsible for the accuracy of any of the figures presented in the article. I am not a financial professional of any kind. Any stock transactions or analysis published should NOT be considered to be investing recommendations. Before making any investing or financial decisions, contact an appropriate professional. This website should be viewed for entertainment purposes only.